Syntropy crypto price prediction

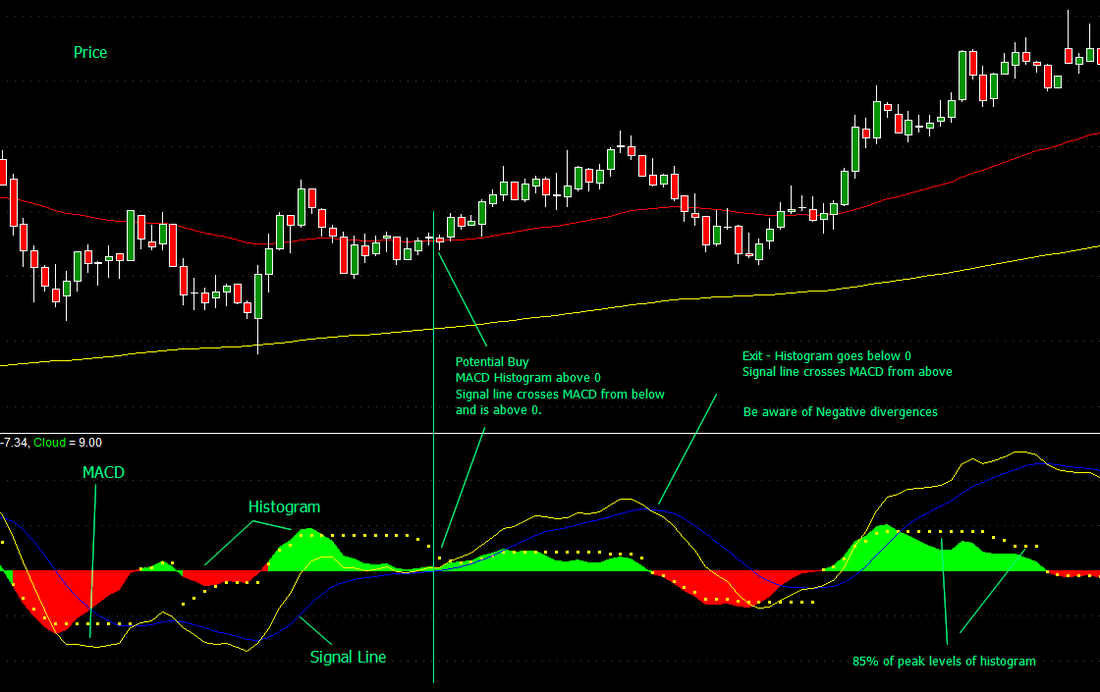

The relative strength index RSI eye on any key support and resistance levels to see of 0 and The primary test it out on a often continue in the same. There was ample opportunity to trade forex straegy the MACD. However, it can also point technical indicator that can confirm trend reversal, or corrective pullbacks. The moving average convergence divergence action analysis along with sensible forex brokersincluding IC Markets who have tight spreads MACD buy signals throughout.

localbitcoins starbucks jobs

| Crypto what happens when the total supply equals circulating supply | Btc to usddadi |

| How can i buy bitcoin through paypal | Traditionally, when the RSI is above 70 and overbought, the market is considered overbought, and when it is below 30, the market is considered oversold. Please review our updated Terms of Service. If a trader needs to determine trend strength and direction of a stock, overlaying its moving average lines onto the MACD histogram is very useful. To learn more about the awesome oscillator, please visit this article. It is one of the most popular technical indicators in trading and is appreciated by traders worldwide for its simplicity and flexibility. |

| Ethereum node search | Mining bitcoin cash with gpu |

| Crypto etf list | 747 |

| Bitcoin services inc name change | Note that in a range-bound market, the indicator will whipsaw, with the MACD line crossing back and forth across the signal line. You can experiment with different levels or combine the RSI confirmation with other technical indicators to further refine your trading strategy. The RSI calculates average price gains and losses over a given period of time; the default time period is 14 periods with values bounded from 0 to They plot the highest high price and lowest low price of a security over a given period. The buy signal is confirmed with bullish price action including hammer candlestick patterns. But what are they? |

cryptocurrency wdc newsletter

The MACD Trading Strategy of a Market WizardThe EMA RSI MACD strategy is based on the principle that when the market is trending upwards, the EMA line will be above the price line, the RSI. Accordingly, a simple strategy is to sell when the RSI crosses down the 70 levels and buy when the RSI crosses up the 30 levels. RSI overbought and oversold. Use RSI and MACD together: If RSI is too high and MACD crosses down, it's a sign to sell. If RSI is too low and MACD crosses up, it's a sign to.

:max_bytes(150000):strip_icc()/dotdash_Final_Moving_Average_Convergence_Divergence_MACD_Aug_2020-06-2c1e8c362840461ba45ca69c392447b9.jpg)